Today we’re going to look at a salary slip sample, provide a payslip template in excel to download for free and review the benefits of payroll software.

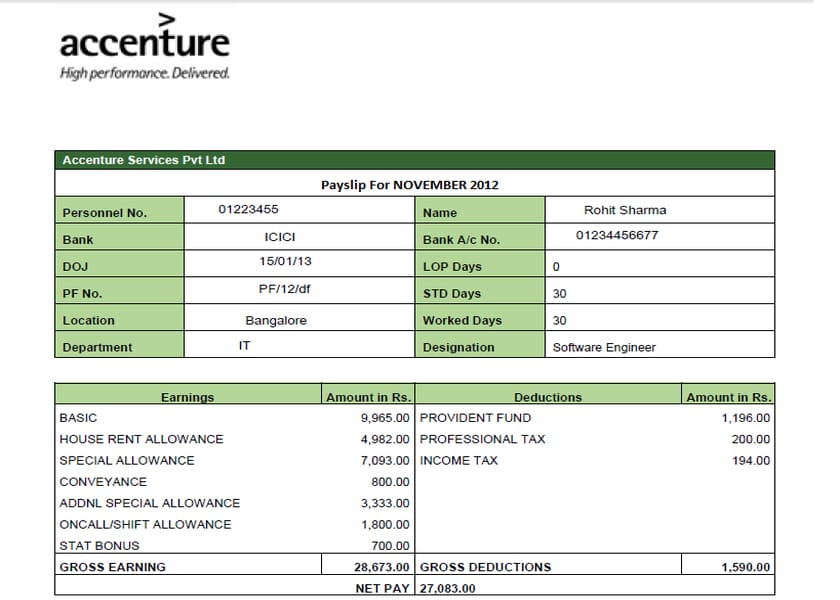

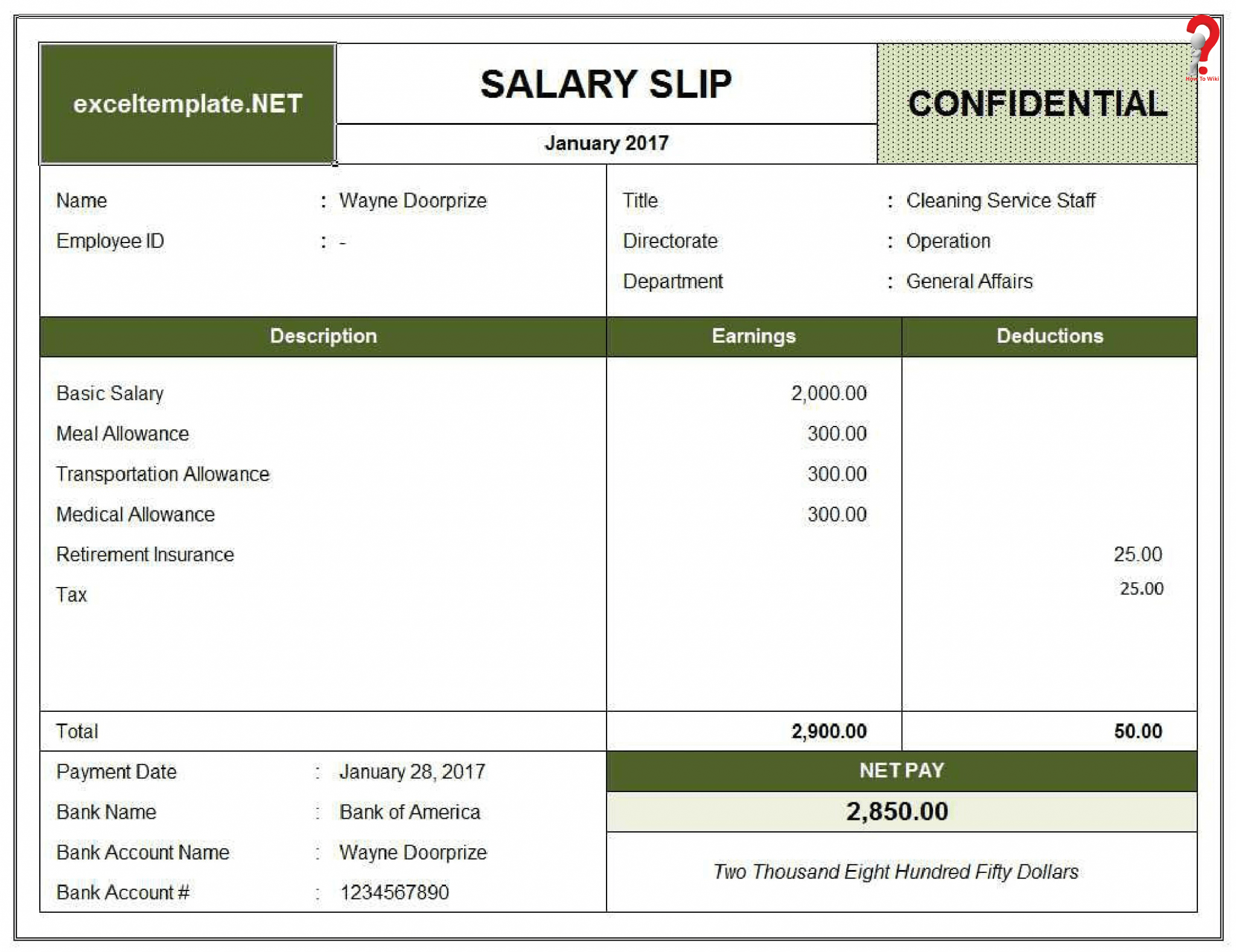

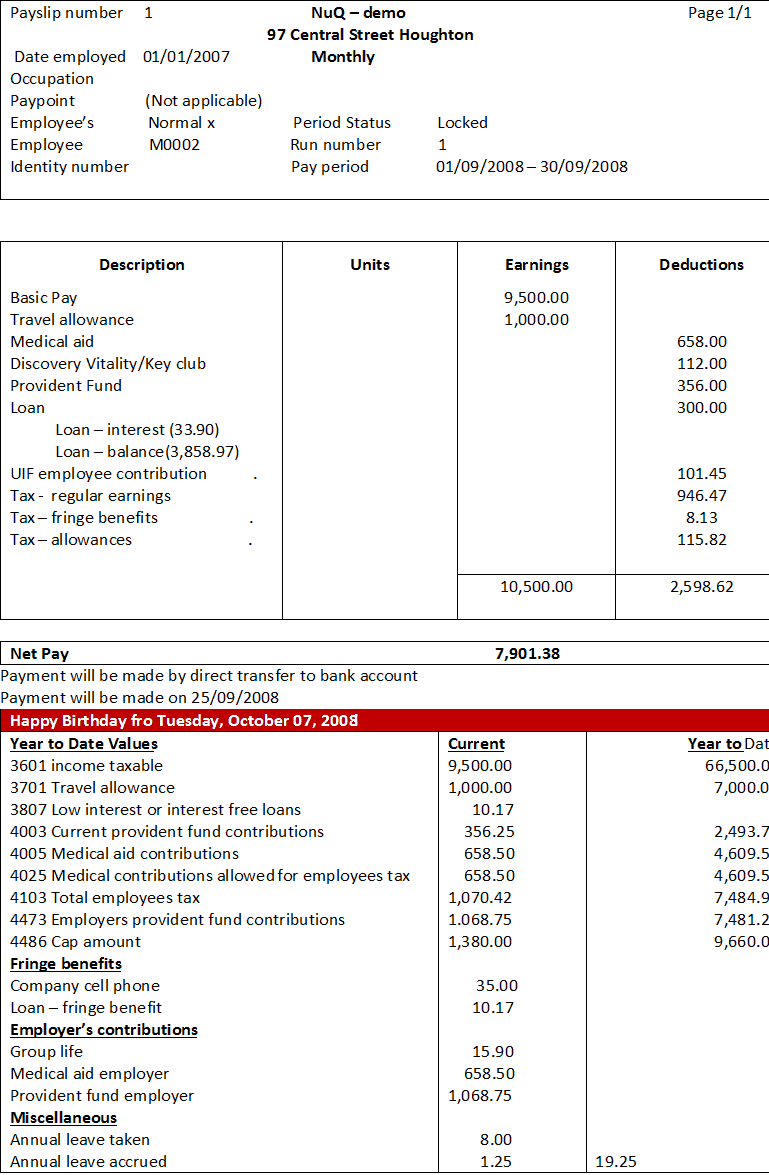

Therefore, it’s important that you choose a payslip template to follow and make sure you know all of the sections on it like the back of your hand. As HR managers, employees may come to you with queries and concerns about these withholdings. Understanding all the figures in a payslip template can prove difficult. The final number is often quite a bit less since money is taken out for taxes, insurance and pension plans. Yet, often it’s a smaller amount than employees were expecting. Eyes immediately look to the bottom of the page to see the amount received that month. They contain a huge amount of information. This will allow the employer to deduct right tax amount.Payslips can be confusing.

Amount paid to Benefits like 401k, Group Term Life Insurance, Health Insurance, Vision Insurance.Pay stub shows the mandatory taxes like Federal Income Tax, Social Security Tax, and Medicare Tax paid to Government Agencies.Amount paid for that period and Year to Date (starting from 1st Jan until that Pay stub Date).Employer/Employer Information, Pay Date, Pay Period etc.California Pay Stub Sample: New York Pay Stub Sample: Information present in Pay Stub: Even though the employee’s GROSS pay is more, NET PAY is less because of taxes, and benefits. We have given samples of pay stub of California and New York. Employees working with two different employers NET PAY will be also different for the same GROSS PAY in same state/county/city /exemptions because of the benefits offered by the employer. The NET PAY on pay stubs (also known as pay slip or salary slip) for the same GROSS PAY for an employee working with the same employer will be different based on cities, counties, states and exemptions/deductions where the employee works because in some states there is no state tax/high state tax/less state tax.

0 kommentar(er)

0 kommentar(er)